Preparing and filing 1099 forms can feel like an annual tax season puzzle, but with the right strategy, it's a manageable task. For the 2023 tax year (filed in 2024), new IRS regulations have significantly changed the game, lowering the electronic filing threshold for certain information returns from 250 to just 10. This means most businesses that pay independent contractors will need to embrace modern methods for generating 1099s: software, online, or manual processing, with a heavy lean towards digital.

Choosing the right approach isn't just about ticking a box; it's about efficiency, accuracy, and staying compliant. This guide will walk you through each method, highlighting their pros and cons, and helping you identify the best fit for your business as you gear up for the upcoming filing season.

At a Glance: Key Takeaways for 1099 Filing

- E-Filing is Now Standard: For the 2023 tax year (filed in 2024), if you issue 10 or more 1099s, you must file them electronically with the IRS.

- Know Your 1099s: The 1099-NEC reports non-employee compensation ($600+) for services, while the 1099-MISC covers other income like rents or royalties.

- Deadline Alert: The typical deadline for filing 1099-NEC forms with the IRS and providing a copy to your contractors is January 31st. Missing it means penalties.

- Manual Filing is Mostly Obsolete: Due to the 10-form e-filing mandate, traditional paper filing is rarely a viable option for businesses.

- Software & Online Services Reign: These methods offer automation, accuracy, and ensure compliance with e-filing requirements.

- Crucial Features: Look for automated generation, e-filing, accounting software integration, data security, and contractor management when choosing a solution.

- Avoid Common Mistakes: Double-check contractor info, meet deadlines, correctly classify workers, and maintain impeccable records.

The New Reality: Why 1099 Filing is More Critical Than Ever

Gone are the days when you could simply hand-fill forms and mail them off unless you have a tiny handful of contractors. The IRS is pushing for digital efficiency, and businesses need to adapt. But first, a quick refresher on what these forms are all about.

1099 forms are essentially how the IRS tracks payments made to individuals or unincorporated businesses that aren't your employees. Think of anyone you pay for services (like a freelance graphic designer, a consultant, or a repair person) or other income (like rent for an office space).

The two most common forms you'll encounter are:

- 1099-NEC (Non-Employee Compensation): This is the star of the show for most businesses. It reports payments of $600 or more to independent contractors for services rendered. If you hire freelancers, consultants, or anyone performing work as an independent entity, this is your form.

- 1099-MISC (Miscellaneous Income): While less common for services these days, the 1099-MISC still has its place. It covers other types of payments like rents, royalties, fishing boat proceeds, or prize and award money, typically also for $600 or more.

The crucial date to remember is January 31st. That's the typical deadline for filing 1099-NEC forms with the IRS and, just as importantly, getting a copy to your contractors. Missing this deadline can lead to penalties, which quickly add up, so timely and accurate filing is paramount.

The IRS E-Filing Mandate: Game Changer for Businesses

The big news for the 2023 tax year (filed in 2024) is the significantly lowered electronic filing threshold. It used to be 250 forms; now, it's just 10 forms. This small number means that practically any business that regularly engages independent contractors will be required to e-file. There's no escaping it for most.

This mandate isn't just a suggestion; it's a rule. All information returns must be corrected using the same filing method as the original return, so starting with the right electronic method from the get-go is key. This shift underscores why understanding the digital options for generating 1099s has never been more vital.

Understanding Your Options for Generating 1099s

With the IRS mandate in full effect, your choices for 1099 generation have narrowed, but the available digital methods offer powerful advantages. Let's break down the primary avenues.

1. Manual Processing (The Traditional Route… Mostly Obsolete)

Remember the good old days of filling out paper forms? For 1099s, those days are largely behind us for most businesses.

When it used to make sense:

Historically, manual processing involved ordering physical 1099 forms from the IRS or an office supply store, filling them out by hand or typewriter, making copies for the contractor and your records, and then mailing them to both the contractor and the IRS. This was viable only for businesses with very few contractors (think 1-2) and simple payment structures.

Why it's no longer practical (or compliant for many):

The new IRS e-filing mandate of 10 or more forms effectively renders manual processing obsolete for the vast majority of businesses. If you have 10 or more contractors, you cannot use the manual method for federal filing. Even for those with fewer than 10, the disadvantages are significant:

- Time-Consuming: Each form takes time to prepare, double-check, and mail.

- Prone to Error: Human error in transcription or calculation is common.

- Lack of Audit Trail: Tracking proof of mailing and receipt can be cumbersome.

- No E-Filing: The biggest hurdle is the inability to comply with the e-filing mandate, leading to potential penalties.

In short, while technically still an "option" for a tiny fraction of businesses (those issuing 9 or fewer forms), manual processing is a relic of the past for 1099s. It's time to look at digital solutions.

2. Online Services & IRS Direct Portals

Moving into the digital realm, online services offer a more streamlined way to handle your 1099s. These range from dedicated web-based platforms to direct portals provided by the IRS itself.

Overview: These are typically browser-based solutions that allow you to input contractor data, generate forms, and often e-file directly with the IRS. They strike a balance between the simplicity of manual entry and the power of dedicated software.

Advantages:

- Convenience: Access from anywhere with an internet connection.

- Often Cost-Effective: Many services have per-form fees that can be economical for medium volumes.

- Direct IRS Submission: Many platforms handle the e-filing process on your behalf, ensuring compliance.

Disadvantages: - Feature Limitations: May lack the advanced reporting or integration capabilities of full software.

- Data Security Concerns: While most reputable services are secure, always verify their data protection policies.

- Learning Curve for IRS Portals: Direct IRS systems can be less user-friendly than commercial software.

Let's look at two critical IRS e-filing systems, often integrated into online services or software:

IRS's Information Returns Intake System (IRIS)

IRIS is the IRS's newer, simplified system for e-filing. The good news? When filing through certain accounting software like Accounting CS, you often do not need an IRIS Transmitter Control Code (TCC) or Reporting Agent PIN. This makes it a more direct and less complicated pathway for many.

How it typically works (via integrated software):

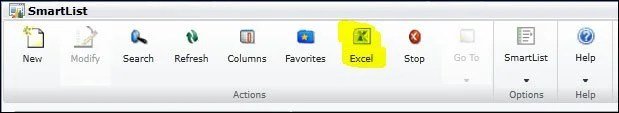

- Within your accounting software, you'd select the option to process payroll tax forms.

- Change the filing method for Copy A (the IRS copy) to "Electronic."

- Generate the necessary file from your client data.

- Navigate to the electronic forms processing section of your software.

- Select transmission information, typically designating a contact person.

- Preview your selected forms.

- Finally, select "Transmit Forms" to send them directly to IRIS.

IRIS is a strong option because it aims to simplify the e-filing process, especially when leveraged by your existing accounting tools. It’s important to note that Accounting CS, for example, does not support CSV file upload directly to IRIS, highlighting that each software implementation can vary.

IRS's Filing Information Returns Electronically (FIRE) System

The FIRE system is the IRS's traditional platform for e-filing a wide variety of information returns. It's robust but requires a bit more setup. For the FIRE system, you must request authorization and obtain a Transmitter Control Code (TCC) online from the IRS before you can file. This TCC is your unique identifier for filing through FIRE.

How it typically works (via integrated software):

- Similar to IRIS, you'd start by processing payroll tax forms in your accounting software.

- For Copy A, you'd typically select "Internet" as the filing method (or similar phrasing).

- Process your client data to add it to a batch file.

- Go to the internet/magnetic files processing section of your software.

- Select and preview your file.

- Create the necessary files, which will be in a format compatible with FIRE.

- Finally, you'll upload this generated file directly to the IRS FIRE program website.

While more involved due to the TCC requirement, FIRE is a reliable system, especially for those with higher volumes or specific compliance needs that might necessitate direct interaction with the IRS system.

Both IRIS and FIRE are the backbones of IRS e-filing. Many commercial software and online services act as intermediaries, streamlining the process and handling the technical file generation and submission to these IRS systems on your behalf.

3. Dedicated 1099 Software & Accounting Integrations (The Smart Solution)

For most businesses navigating the new e-filing landscape, dedicated 1099 software or robust accounting software with integrated 1099 capabilities is the preferred, and often necessary, method. These solutions offer unparalleled efficiency, accuracy, and peace of mind.

Overview: This category encompasses everything from specialized 1099 filing platforms to comprehensive payroll and accounting systems (like QuickBooks Online Payroll or Paychex Flex) that include 1099 generation as part of their suite of services. They are designed to automate, validate, and submit your forms with minimal manual effort.

Benefits:

- Automation: Generate and file forms with just a few clicks, often importing data directly from your accounting records.

- Accuracy: Built-in validation checks help catch errors before submission, reducing costly corrections and penalties.

- Compliance: Ensures all forms are correctly formatted and submitted according to IRS regulations, including the e-filing mandate.

- Integration: Seamlessly connects with existing accounting systems (e.g., QuickBooks, Xero, Sage) to pull data effortlessly.

- Time Savings: Drastically reduces the time spent on preparing and filing, freeing you up for other business tasks.

- Contractor Copies: Many solutions automatically email or mail copies of 1099s directly to your contractors.

When it's the best choice:

Given the new IRS mandate, dedicated software or integrated accounting solutions are the best, and often only, viable choice for virtually all businesses paying 10 or more independent contractors. They transform a complex, error-prone task into a streamlined, automated process.

Key Features to Look for in 1099 Software

When evaluating a 1099 solution, keep these essential features in mind. They differentiate a basic tool from a powerful asset:

- Automated 1099 Generation and Filing: This is paramount. Look for software that can:

- Generate and file forms with minimal clicks.

- Import data from your existing accounting software (QuickBooks, Xero integration is a big plus).

- Offer e-filing capabilities directly with the IRS (often via IRIS or FIRE).

- Automatically email or mail 1099s to contractors.

- Data Security and Compliance: Your contractors' sensitive information is at stake. Ensure the software offers:

- Secure data storage and encryption (e.g., SOC 2 compliance).

- Guaranteed compliance with current IRS regulations and data privacy laws (like GDPR, if applicable).

- Contractor Management and Data Import: Efficiently managing contractor information is a cornerstone. Seek:

- Tools to store and manage contractor details (names, addresses, TINs, payment history).

- The ability to easily import data from spreadsheets (CSV) or other sources.

- Validation checks for TINs (Taxpayer Identification Numbers).

- Reporting and Tracking: To stay on top of your filing status:

- Robust features to track 1099 filing status for each contractor.

- Ability to generate reports on 1099 activity and total contractor payments.

- Pricing and Scalability: Consider your current and future needs:

- Flexible and transparent pricing options (per-form, per-client, unlimited licenses).

- Scalability to grow with your business and increasing number of contractors. For example, some services like CS Connect might charge $14 per client per form type for federal 1099 e-filing, or offer an unlimited e-filing license.

Navigating the Software Landscape: Top Tools for 2025 Filing

The market is rich with 1099 software solutions, each with its unique strengths. Here’s a look at some of the top contenders for small to mid-sized businesses, based on their features and target users.

- Track1099:

- Best for: Small businesses and freelancers.

- Highlights: Comprehensive and intuitive, offering automated e-filing and strong accounting software integration. It simplifies what can be a complex process.

- Tax1099:

- Best for: Small businesses and self-employed professionals needing robust features.

- Highlights: A dynamic solution that automates creation, validation, and e-filing. It's cloud-based, secure, and integrates with many accounting tools, ensuring IRS compliance.

- QuickBooks Online Payroll:

- Best for: Small to mid-sized businesses already within the QuickBooks ecosystem.

- Highlights: A versatile solution that seamlessly integrates payroll and 1099 processing. It offers automated tax calculations and filing, leveraging existing QuickBooks Online data for efficiency.

- 1099-Etc:

- Best for: Small businesses and freelancers needing a focused 1099 filing solution.

- Highlights: A dedicated tool that automates data extraction, generation, and e-submission. It boasts robust reporting and tracking features and integrates with various accounting systems.

- eFile4Biz:

- Best for: Businesses with high filing volumes.

- Highlights: An advanced online platform designed to automate data collection, generation, and e-submission. Its user-friendly interface and real-time tracking make it efficient for large batches.

- Yearli:

- Best for: Small to mid-sized businesses valuing streamlined processes.

- Highlights: An innovative solution that automates the end-to-end 1099 process. It features an intuitive dashboard, customizable reporting, and seamless accounting software integration.

- Ez1099:

- Best for: Small businesses and freelancers seeking a straightforward, cost-effective tool.

- Highlights: Known for its user-friendly interface, Ez1099 automates preparation, validation, and e-submission. It’s an accessible choice for those who need simplicity.

- Lacerte:

- Best for: Accounting professionals managing complex, high-volume returns.

- Highlights: A professional-grade tax preparation software with robust 1099 capabilities. It offers advanced reporting, strong data accuracy features, and is optimized for managing many client returns.

- Paychex Flex:

- Best for: Small to mid-sized businesses needing an all-in-one payroll and HR solution.

- Highlights: A comprehensive platform that streamlines 1099 filing as part of its broader payroll and HR management services. It’s mobile-friendly, scalable, and integrates seamlessly with payroll.

Choosing from this list depends heavily on your specific business size, existing accounting setup, and the volume of forms you anticipate filing.

Avoiding the Pitfalls: Common 1099 Mistakes and How to Dodge Them

Even with the best software, awareness is your first line of defense against common errors that can lead to IRS scrutiny and penalties.

- Incorrect Contractor Information: This is perhaps the most frequent mistake. A simple typo in a name, address, or, critically, the Taxpayer Identification Number (TIN) can cause forms to be rejected.

- How to avoid: Always request a completed and signed W-9 form from every independent contractor before you make their first payment. This form collects all the necessary information directly from them, ensuring accuracy.

- Missing Deadlines: The January 31st deadline for 1099-NEC forms (to both the IRS and the contractor) is firm. Penalties for late filing can start at $60 per form and go much higher, depending on how late you are.

- How to avoid: Mark your calendar! Utilize your chosen software's automated reminders. Start collecting W-9s and reviewing payment records well in advance of the deadline, ideally throughout the year.

- Misclassifying Workers: One of the most severe mistakes is incorrectly classifying a worker as an independent contractor when they should be an employee. The IRS has strict guidelines, and misclassification can lead to significant back taxes, penalties, and legal issues.

- How to avoid: Understand the IRS guidelines for employee vs. independent contractor. If there's any doubt, consult a qualified tax professional. Don't base classification purely on what the worker prefers.

- Inaccurate Record-Keeping: You need to back up every payment reported on a 1099. If your records are sloppy, reconciling discrepancies or responding to IRS inquiries becomes a nightmare.

- How to avoid: Maintain detailed, organized records of all payments made to contractors throughout the year. This includes invoices, payment dates, amounts, and descriptions of services. Good accounting software makes this automatic.

Choosing Your Champion: How to Select the Right 1099 Solution

Selecting the perfect 1099 generation method and software isn't a one-size-fits-all decision. It requires a thoughtful assessment of your business's unique needs. To dive deeper into the overarching process, you can always learn how to generate a 1099 from start to finish.

Factors to Consider

Before you even start looking at specific products, define what's important to your business:

- Number of Contractors: This is paramount. If you have 10 or more, e-filing is mandatory, pushing you towards software or online services. If you have hundreds, you'll need robust bulk processing capabilities.

- Budget: Solutions range from free (if you e-file directly with IRS IRIS system, for instance, but not through commercial software) to per-form fees to annual subscriptions. Determine what you can realistically spend.

- Integration Needs: Do you want your 1099 process to seamlessly integrate with your existing accounting software (e.g., QuickBooks, Xero) or payroll system? This can be a huge time-saver.

- Specific Required Features: Do you need automated emailing of contractor copies? State filing capabilities? Advanced reporting? Look beyond just basic form generation.

The Selection Process

Once you know your needs, follow these steps to narrow down your choices:

- Assess Your Needs: Use the factors above to create a clear picture of what you're looking for.

- Research Software Options: Explore the top contenders mentioned earlier and others. Read reviews from businesses similar to yours.

- Utilize Free Trials or Demos: This is crucial. Hands-on experience with the interface and features will tell you more than any brochure.

- Read User Reviews: Websites like Capterra, G2, or TrustRadius offer valuable insights into real-world user experiences, including customer support quality.

- Make an Informed Decision: Don't rush. Use a checklist to ensure your chosen software meets your critical requirements.

Your Actionable Checklist for 1099 Software

Use this checklist to evaluate any potential solution:

- Supports Your 1099 Volume? Can it handle your current number of contractors and scale for future growth?

- Within Budget? Are the pricing options (per-form, per-client, unlimited) transparent and affordable?

- Integrates with Accounting Software? Does it connect seamlessly with your existing accounting or payroll system?

- Offers Automated/E-Filing? Does it simplify submission to the IRS (via IRIS/FIRE) and contractors?

- Provides Secure Data Storage? Is your sensitive contractor data protected with robust security measures?

- Easy User Interface? Is it intuitive and easy for you and your team to navigate?

- Reliable Customer Support? What do user reviews say about their support? Is it accessible when you need it most?

Your Blueprint for a Smooth 1099 Filing Season

Preparing for 1099 season doesn't have to be a scramble. By adopting proactive strategies and leveraging the right tools, you can ensure a smooth, compliant, and stress-free process.

- Maintain Accurate Records Throughout the Year: Don't wait until January. Regularly update contractor information (contact details, TINs, payment info) as changes occur. Keep detailed, categorized records of all payments made to contractors in real-time. This ongoing diligence is the single most impactful thing you can do to ease your filing burden.

- Fully Utilize Your Software's Features: If you've invested in 1099 software, get the most out of it. Set up automated reminders for key deadlines and tasks. Use its reporting tools to monitor filing progress and identify any missing W-9s or incomplete payment records well before the January 31st crunch.

- Stay Informed and Seek Expert Help When Needed: Tax laws, especially around e-filing mandates, can change. Follow IRS updates and guidelines. For complex situations, such as worker misclassification concerns or unique payment structures, don't hesitate to consult a qualified tax professional. Their expertise can save you significant headaches and costs in the long run.

By embracing modern methods, selecting the right tools, and staying vigilant with your record-keeping, you can transform 1099 season from a looming dread into another efficiently managed aspect of your business operations.