Ever received a piece of mail from a client, bank, or even a state agency that looked like a tax form, but wasn't your familiar W-2? Chances are, it was a 1099. For anyone navigating the world of freelance work, investments, or various other income streams outside a traditional employment setup, Understanding 1099 Forms: Types and Purpose is absolutely crucial. These aren't just obscure government documents; they're the IRS's way of tracking income that isn't a regular salary, ensuring that everyone reports their earnings accurately.

Think of 1099s as informational postcards to the IRS, signaling money you've received from various sources. If you're an independent contractor, an investor, or even someone who received unemployment benefits, these forms are your essential companions come tax season. They play a vital role in keeping your financial house in order and staying compliant with tax regulations.

At a Glance: Your 1099 Essentials

- What they are: Informational tax documents that report non-employment income to the IRS.

- Why they matter: They help the IRS verify all income earned outside of traditional W-2 wages.

- Who gets them: Freelancers, investors, retirees, anyone receiving certain types of government payments, and more.

- Who sends them: The businesses or entities that paid you the income.

- When to expect them: Generally by January 31st of the year following the income, though some have slightly later deadlines.

- Key takeaway: Receiving a 1099 doesn't automatically mean you owe tax, but it does mean the IRS knows about the income.

What Are 1099 Forms? The Big Picture

At its heart, a 1099 form is an informational return. It’s not a bill, nor is it necessarily a sign you owe more tax. Instead, it’s a notification to both you and the IRS about specific types of income you've received throughout the year that aren't reported on a W-2 form. This distinction is critical because it highlights the fundamental difference between traditional employment and other forms of earning.

While a W-2 reports wages, salaries, and tips from an employer who withholds taxes from your paycheck, a 1099 covers virtually everything else: payments for contract work, dividends from investments, interest earned on savings, proceeds from real estate sales, and even certain government benefits. The entities making these payments – be it a client, a bank, or a state agency – are responsible for generating the appropriate 1099 form and sending copies to you and the IRS. This process ensures transparency and helps the IRS track income that might otherwise go unreported, ultimately aiding in accurate tax reporting and compliance across the board.

Who Needs a 1099? Decoding "1099 Employee"

The term "1099 employee" is a common shorthand, but it's technically a misnomer. There's no such thing as a "1099 employee" in the IRS's eyes. Instead, individuals who receive 1099 forms for their work are considered independent contractors, freelancers, gig workers, or self-employed individuals. Unlike W-2 employees, who have their taxes, Social Security, and Medicare contributions withheld by an employer, these independent workers are responsible for managing their own taxes.

If you perform work for a client and they don't consider you a regular employee, you're likely operating as an independent contractor. Before they pay you, they'll typically ask you to fill out a Form W-9, which provides them with your taxpayer identification number (TIN) – usually your Social Security number or Employer Identification Number (EIN) – so they can accurately report payments made to you on a 1099 form. This distinction is crucial for tax purposes because it impacts how your income is taxed, what deductions you can claim, and your obligations for self-employment taxes (Social Security and Medicare).

When to Expect Your 1099s (and What to Do If They're Missing)

For most 1099 forms, the payer must send them to you by January 31st of the year following the income accrual. For example, income earned in 2023 would result in 1099 forms typically arriving by January 31st, 2024. However, there are a few exceptions: some forms, like Form 1099-B (Proceeds from Broker and Barter Exchange Transactions) or 1099-S (Proceeds from Real Estate Transactions), might have a slightly later deadline, generally by mid-February.

Life happens, and sometimes forms get lost in the mail or are simply delayed. If you're expecting a 1099 form and haven't received it by mid-February, don't panic, but do take action. Your first step should always be to contact the payer directly. They can verify if the form was sent, confirm the address, or issue a duplicate. If you still can't get the form after contacting the payer, or if they refuse to send it, then you should reach out to the IRS for assistance. Remember, the IRS still expects you to report all your income, even if you don't receive a corresponding 1099 form.

It's also worth noting that if you have multiple types of taxable nonemployee income from the same institution – for instance, interest and dividends from a brokerage account – you might receive a consolidated 1099. This single document bundles information from several different 1099 types, simplifying your paperwork.

The Most Common 1099 Forms You'll Encounter

While there's a long list of 1099 forms, a handful are far more common than others. Understanding these core types will cover most people's needs.

Form 1099-NEC: Nonemployee Compensation

This form is the cornerstone for freelancers, independent contractors, and gig workers.

- Purpose: Reports non-employee compensation paid to individuals who are not considered employees of the payer. This includes payments for services rendered in a trade or business.

- Who gets it: Freelancers, consultants, independent contractors, artists, writers, delivery drivers, and other self-employed individuals.

- Threshold: Typically issued for payments of $600 or more during the calendar year.

- Key Detail: Reintroduced in 2020, Form 1099-NEC replaced Box 7 of Form 1099-MISC for reporting non-employee compensation. This change was made to simplify reporting for businesses and better align with tax filing deadlines.

Form 1099-MISC: Miscellaneous Information

Before 2020, Form 1099-MISC was the catch-all for non-employee compensation. Now, its role is more specialized.

- Purpose: Reports various types of miscellaneous income that aren't covered by other specific 1099 forms. This includes rent, royalties, prizes, awards, and payments to attorneys.

- Who gets it: Landlords receiving rent, individuals receiving royalties (e.g., from books or music), winners of prizes or awards, and recipients of legal settlements (in some cases).

- Threshold: Generally issued for payments of $600 or more for most types of miscellaneous income. For royalties, it can be as low as $10.

- Key Detail: If you received non-employee compensation before 2020, it would have been on a 1099-MISC. Now, that income is on a 1099-NEC.

Form 1099-INT: Interest Income

If you have a savings account, a CD, or other interest-bearing accounts, this form is for you.

- Purpose: Reports interest income earned from banks, credit unions, brokerages, and other financial institutions.

- Who gets it: Anyone who earns interest from bank accounts, savings bonds, certificates of deposit (CDs), or similar financial products.

- Threshold: Typically issued for interest amounts of $10 or more. Some exceptions exist for lower amounts.

- Key Detail: Even if you only earned a few dollars of interest and didn't receive a 1099-INT, you are still legally required to report that income on your tax return.

Form 1099-DIV: Dividends and Distributions

For those with investments, 1099-DIV is a familiar sight.

- Purpose: Reports dividends and capital gain distributions from stocks, mutual funds, and other investment vehicles.

- Who gets it: Investors who receive dividends from stocks or distributions from mutual funds.

- Threshold: Usually issued for amounts over $10.

- Key Detail: Dividends from credit union share accounts are actually considered interest and will appear on Form 1099-INT, not 1099-DIV. This is a common point of confusion.

Form 1099-B: Proceeds from Broker and Barter Exchange Transactions

This form details the outcomes of your investment trading.

- Purpose: Reports income from the sale of stocks, bonds, options, other securities, and certain bartering transactions made through exchanges.

- Who gets it: Investors who sold securities, including stocks, bonds, and mutual funds.

- Threshold: Issued regardless of the amount sold; any sale transaction will typically generate a 1099-B.

- Key Detail: This form is crucial for calculating capital gains or losses, as it often includes the cost basis of the assets sold, simplifying your tax calculations significantly.

Form 1099-S: Proceeds from Real Estate Transactions

If you sold property, expect this form.

- Purpose: Reports gross proceeds from the sale or exchange of real estate property, including land, residential homes, and commercial buildings.

- Who gets it: Individuals or entities who sold real estate during the year.

- Threshold: Typically issued for any such transaction, regardless of the amount.

- Key Detail: While it reports the gross proceeds, it doesn't mean all of it is taxable. Your cost basis, selling expenses, and home sale exclusions (if applicable) will reduce your taxable gain.

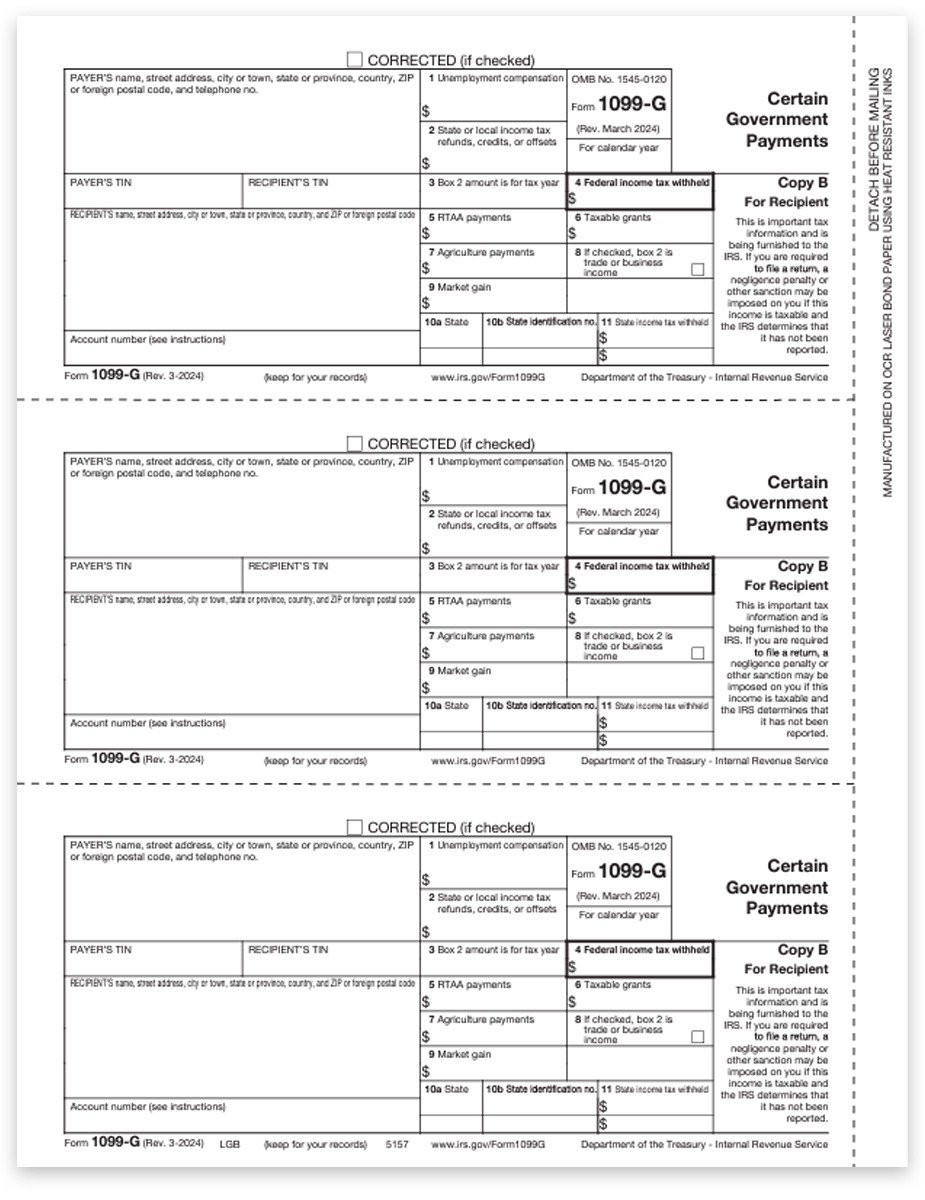

Form 1099-G: Certain Government Payments

Government support, in many forms, is often reported here.

- Purpose: Reports various government payments, including unemployment compensation, state or local income tax refunds, agricultural payments, and certain taxable grants.

- Who gets it: Individuals who received unemployment benefits, a state or local income tax refund (especially if they itemized deductions in the prior year), or other specified government payments.

- Threshold: Generally sent for any government payments received that fall into these categories.

- Key Detail: If you received a state tax refund, only the taxable portion (if any) is reported. This usually applies if you itemized deductions on your federal return in the year the state tax was paid.

Beyond the Basics: Other Important 1099 Forms

While the common forms cover a wide range of income, many specialized 1099 forms exist for unique financial situations. Knowing about them can save you a surprise during tax season.

- 1099-A (Acquisition or Abandonment of Secured Property): Issued by lenders if they foreclosed on your property, repossessed it, or you abandoned it. The cancellation of debt resulting from these actions is generally taxable income.

- 1099-C (Cancellation of Debt): If a lender forgives a debt you owe (e.g., credit card debt, mortgage debt not covered by 1099-A), they issue this form. The forgiven amount is usually taxable income, though exceptions apply (e.g., insolvency).

- 1099-CAP (Changes in Corporate Control and Capital Structure): For shareholders who receive cash, stock, or other property due to a corporate acquisition or a significant change in the company's capital structure.

- 1099-K (Payment Card and Third Party Network Transactions): Reports business income received through credit card payments or third-party payment networks (like PayPal, Stripe, Square) for goods and services. For the 2024 tax year and beyond, this form is generally issued if transactions exceed $5,000, regardless of the number of transactions. Note: Original guidance had higher thresholds, but current legislation aims for a lower amount to capture more data. For 2025 onwards, the threshold is typically issued if transactions exceed 200 AND $20,000.

- 1099-LTC (Long Term Care and Accelerated Death Benefits): Reports payouts from long-term care insurance contracts and accelerated death benefits from life insurance policies. These are often non-taxable, but the form provides the information.

- 1099-OID (Original Issue Discount): If you bought bonds, notes, or other financial instruments at a discount to their face value, and they have a maturity of over one year, this form reports the "original issue discount" as taxable interest income.

- 1099-PATR (Taxable Distributions Received From Cooperatives): For members of a cooperative who receive patronage dividends (income shared by the co-op with its members). Issued for amounts of $10 or more.

- 1099-Q (Payments from Qualified Education Programs): Reports money distributed from a 529 plan or Coverdell ESA. Earnings used for qualified education expenses are generally not taxable, but the form provides the details needed to determine taxability.

- 1099-R (Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, and Insurance Contracts): A very common form for retirees, reporting distributions from various retirement accounts, pensions, and annuities, including certain loan treatments and disability payments.

- 1099-SA (Distributions From an HSA, Archer MSA, or Medicare Advantage MSA): Reports distributions from health savings accounts (HSAs), Archer Medical Savings Accounts (MSAs), or Medicare Advantage MSAs. Generally not taxable if used for qualified health expenses, but the form documents the withdrawals.

Navigating Your 1099s: What to Do When They Arrive

When those 1099 forms start rolling in, it's not enough to just glance at them. They require your attention to ensure accuracy and prevent potential headaches come tax time.

- Review for Accuracy: As soon as you receive a 1099, compare the information to your own records. Does the payer's name match? Is your Social Security Number correct? Does the reported income align with what you believe you earned or received? Sometimes errors occur, and catching them early allows you to request a corrected form from the payer before filing.

- Reconcile with Your Records: For independent contractors, this means cross-referencing your 1099-NEC against your invoices and payment logs. For investors, check your 1099-DIV and 1099-INT against your brokerage statements. This step is crucial for accurate reporting and ensures you haven't overlooked any income or incorrectly reported an amount.

- Understand Taxability: Receiving a 1099 means the income was reported to the IRS, but it does not automatically imply tax liability. For example, specific deductions might apply to your non-employee compensation, or certain investment income might be sheltered in a tax-advantaged account. Distributions from an HSA or 529 plan, if used for qualified expenses, are often not taxable, even though they're reported on a 1099-SA or 1099-Q. Always understand the nature of the income and its specific tax rules.

- Keep Them Organized: Create a dedicated folder, digital or physical, for all your tax documents, including all 1099s. This will simplify your tax preparation process and serve as a crucial reference if you ever need to amend a return or respond to an IRS inquiry.

Common 1099 Questions & Misconceptions

It's easy to get confused by tax forms. Here are a few clarifications.

"Do I still have to report income if I don't receive a 1099?"

Absolutely. If you earn income that should be reported on a 1099, but the payer doesn't send you one (perhaps because the amount was below the threshold, or due to an oversight), you are still legally obligated to report that income on your tax return. The IRS expects you to report all taxable income, regardless of whether a specific form was issued.

"Does receiving a 1099 mean I owe more taxes?"

Not necessarily. While a 1099 indicates income the IRS knows about, it doesn't automatically calculate your tax liability. For self-employed individuals, business expenses can reduce your taxable income. For investors, capital gains are offset by losses. Deductions, credits, and sheltered income provisions can all reduce your final tax bill. The form is just one piece of the puzzle.

"What's the difference between a 1099-NEC and a 1099-MISC now?"

The key difference is that 1099-NEC is specifically for non-employee compensation, meaning payments for services performed by someone who isn't your employee (like a freelancer or contractor). 1099-MISC is for other miscellaneous income, such as rents, royalties, prizes, and awards. If you're a freelancer, you'll receive a 1099-NEC. If you're a landlord, you'll likely receive a 1099-MISC.

Smart Strategies for Managing Your 1099 Income

Effectively managing your 1099 forms and the income they represent is key to a stress-free tax season and robust financial health.

- Keep Meticulous Records: This cannot be overstated. Maintain detailed records of all income and expenses related to your 1099 activities. This includes invoices, receipts for business purchases, mileage logs, and home office expenses. Good record-keeping is your first line of defense if the IRS ever questions your deductions, and it simplifies the process of filling out Schedule C (Form 1040) for self-employment income.

- Estimate and Pay Quarterly Taxes: If a significant portion of your income comes from 1099 sources, you are likely required to pay estimated taxes quarterly. The IRS operates on a "pay-as-you-go" system. Failing to pay enough tax throughout the year can result in penalties. Calculate your estimated tax liability and make payments using Form 1040-ES.

- Utilize Tax Preparation Software: Tools like TurboTax, H&R Block, or FreeTaxUSA are invaluable for handling 1099 income. Many offer features for easy import of 1099 data, step-by-step guidance, and automatic calculations, helping ensure accuracy and compliance. They can guide you through reporting various income types and claiming eligible deductions.

- Consult a Tax Professional: For complex situations, significant freelance income, or if you're unsure about how to handle specific forms or deductions, working with a qualified tax professional (like a CPA or Enrolled Agent) is highly recommended. They can provide personalized advice, identify opportunities for tax savings, and help you navigate intricate tax laws. They can also provide guidance on how to generate a 1099 if you are a business owner needing to issue them to contractors yourself, which is a common area of inquiry for many businesses how to generate a 1099.

- Stay Organized Year-Round: Don't wait until January to gather your documents. Develop a system for organizing financial records throughout the year. This could be a digital filing system with folders for different income types and expenses, or a physical binder. Being proactive reduces last-minute stress and minimizes the chance of missing important information or deadlines.

By approaching your 1099 income with a clear understanding and a proactive strategy, you can confidently navigate the tax landscape, maximize your deductions, and ensure you're fully compliant, leaving you more time to focus on what you do best.